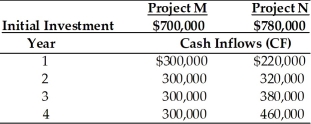

Table 11.8

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below.Tangshan Mining's overall cost of capital is 15 percent,the market return is 15 percent and the risk-free rate is 5 percent.Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation,the NPV for Project N is ________.(See Table 11.8)

Definitions:

Competencies

Refers to the abilities, skills, and knowledge that enable a person to perform a job successfully.

Redundant Jobs

Positions within an organization that are no longer necessary due to various factors such as technological advances, organizational restructuring, or economic downturns, leading to potential job eliminations.

Organizational Strategic Plan

A roadmap created by an organization to guide its decisions and actions towards achieving its long-term goals and objectives.

HR System

A framework or technology used by the HR department to manage employee information, processes, and policies effectively.

Q16: For calculating payback period for an annuity,all

Q21: Credit cards are generally used for such

Q38: Advantages to leasing a car instead of

Q64: For a project that has an initial

Q72: A project must be rejected if its

Q74: A capital expenditure is an outlay of

Q76: Credit cards are commonly used to pay

Q87: At the operating breakeven point,_ equals zero.<br>A)

Q122: A treasurer is responsible for a firm's

Q154: The levels of fixed-cost assets and funds