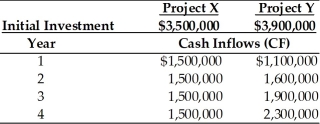

Table 11.10

Nico Manufacturing is considering investment in one of two mutually exclusive projects X and Y which are described below.Nico Manufacturing's overall cost of capital is 15 percent,the market return is 15 percent and the risk-free rate is 5 percent.Nico estimates that the beta for project X is 1.20 and the beta for project Y is 1.40.

-Calculate the risk-adjusted discount rates for Project X and Project Y.(See Table 11.10)

Definitions:

Strategic Behavior

Self-interested economic actions that take into account the expected reactions of others.

International Cartel

An agreement among businesses or countries from different countries to control prices, limit competition, or divide markets.

Fix Prices

The practice of setting and maintaining prices at a certain level, often agreed upon by competitors or mandated by regulation, rather than allowing them to be determined by market forces.

Intel

A leading multinational corporation that specializes in the development of semiconductor chips and microprocessors used in computers.

Q11: One advantage of using a credit card

Q43: Over the life of a loan,the payment

Q59: MasterCard,Visa,and American Express credit cards all allow

Q72: If managers are not owners of their

Q85: Which plan has a higher degree of

Q88: Behavioral approaches _.<br>A) are used to explicitly

Q114: A firm with unlimited funds must evaluate

Q132: Time value of money should be ignored

Q151: The tax effect on the sale of

Q156: Calculate the incremental earnings before depreciation and