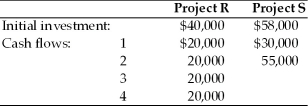

A firm is evaluating two mutually exclusive projects that have unequal lives.The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select.The firm's cost of capital has been determined to be 14 percent,and the projects have the following initial investments and cash flows:

Definitions:

Consumption Sector

The part of the economy that involves the purchase and use of goods and services by households.

Social Security

A government program that provides financial support to people who are retired, disabled, or survivors of deceased workers.

Payroll Tax

Assessments required from employers or their employees, usually expressed as a percentage of the remuneration that staff earn.

Federal Income Taxes

Taxes levied by the national government on individual and business earnings.

Q6: Which of the following may not be

Q10: The capital budgeting process consists of four

Q43: For Proposal 3,the book value of the

Q73: What potential biases exist in project selection

Q74: A capital expenditure is an outlay of

Q75: According to the catering theory,firms cater to

Q83: There are limits on how much a

Q101: All of the following are true of

Q185: In capital budgeting,risk refers to a high

Q202: At about what EBIT level should the