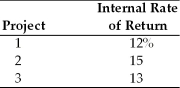

A firm with a cost of capital of 13 percent is evaluating three capital projects.The internal rates of return are as follows:  The firm should ________.

The firm should ________.

Definitions:

Standard Deviations

A statistic that measures the dispersion or variability of a dataset relative to its mean, indicating how spread out the data points are.

Independent

A characteristic of variables in which the value of one variable does not depend on or influence the value of another variable within the context of statistical analysis or experimental design.

Standard Deviations

A measure of the amount of variation or dispersion in a set of values, indicating how much the values deviate from the mean.

Major Injury

A severe physical harm or damage to a person's body, often requiring extensive medical attention or leading to significant impairment.

Q30: Cash flows that could be realized from

Q41: In securing personal loans from family members

Q43: The major shortcoming of the EBIT-EPS approach

Q56: Revolving open-end credit typically does not specify

Q65: The Truth-in-Lending Act (1969)requires which of the

Q101: All of the following are true of

Q109: The break even cash inflow is the

Q117: A _ extends credit by providing a

Q122: The IRR method assumes the cash flows

Q158: Independent projects are those whose cash flows