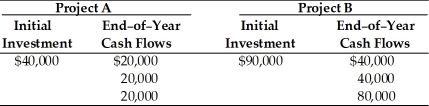

Table 10.3

A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows:

-The new financial analyst does not like the payback approach (Table 10.3) and determines that the firm's required rate of return is 15 percent. Based on IRR, his recommendation would be to ________.

Definitions:

Monopolistically Competitive

Pertaining to a market scenario where firms engage in monopolistic competition, each firm has some control over its price because its product is different from those of its competitors.

Elasticity

A measure of the sensitivity of one variable to changes in another, commonly used to assess changes in demand or supply in response to changes in prices or income.

Demand Elasticity

Refers to the responsiveness of quantity demanded to a change in price.

Product Differentiation

Identifying unique features of a product or service to elevate its attractiveness to a chosen target group.

Q11: A financial manager's primary activities include making

Q13: Jill just borrowed $6,000 and will be

Q33: In the past you have purchased cars

Q74: Credit cards can eliminate the need for

Q76: Finance is _.<br>A) the system of verifying,

Q81: Institutional investors are professional investors who work

Q89: Creditors are willing to extend credit when

Q125: Which of the following activities of a

Q126: simple interest<br>A)statement that lists beginning balance, purchases

Q129: Prestige cards always charge higher interest rates,but