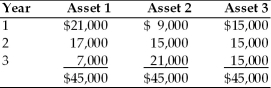

A financial manager must choose between three alternative investments.Each asset is expected to provide earnings over a three-year period as described below.Based on the wealth maximization goal,the financial manager would ________.

Definitions:

Interest Tax Shield

The reduction in income taxes that results from taking the allowable interest expense deductions from taxable income.

Financial Distress Costs

Expenses incurred by a firm facing financial difficulties, including legal, administrative, and potentially bankruptcy-related costs.

Reorganization

Financial restructuring of a failing firm to attempt to continue operations as a going concern.

Going Concern

An assumption that a company will continue to operate in the foreseeable future, without the intention or necessity of liquidation.

Q10: Describe the availability of credit today for

Q13: Buying a car from a dealer with

Q15: Collateral<br>A) gives the lender additional recourse if

Q51: The accept-reject approach involves the ranking of

Q57: A financial manager must choose between four

Q67: A firm is evaluating a proposal which

Q79: Capital gain is the portion of the

Q121: The payback period of a project that

Q122: The IRR method assumes the cash flows

Q126: Profit maximization as a goal is ideal