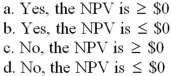

Valuation of a Merger You own stock in Carpet City,Inc.,which has just made a bid of $165 million to purchase Tile Corporation.The two firms currently have cumulative total cash flows of $25 million which are growing at 2 percent annually.Managers estimate that because of synergies the merged firm's cash flows will increase by an additional 4 percent for the first three years following the merger.After the first three years cash flows will grow at a rate of 3 percent.The merged firms are expected to have a beta = 1.75,the risk-free rate is 5.5 percent,and the market risk premium is currently 7.5 percent.Calculate the NPV of the merger.Will you vote in favor of the merger?

Definitions:

Conventional Writing

A form of writing that adheres to established norms and practices, often characterized by standard grammar, punctuation, and style.

Maya Calendar

An ancient system of timekeeping developed by the Maya civilization, remarkable for its complexity and accuracy, including the Long Count calendar.

Agricultural Concerns

Issues affecting the agriculture sector, including sustainability, crop production, animal husbandry, environmental impact, and food security.

Mercantile Pursuits

Activities or endeavors concerned with trade, commerce, and the buying and selling of goods for profit.

Q23: To cover valuable personal property not adequately

Q37: Purchasing power parity (PPP)may not hold exactly

Q45: If you are not planning to stay

Q55: Howett Pockett,Inc.,plans to issue 10 million new

Q61: Homes near areas that have just been

Q69: Calculating Costs of Issuing Stock Paige's Purses,Inc.,needs

Q77: A replacement cost rider is important to

Q79: Which of the following is not a

Q84: Your company has a 25 percent tax

Q110: The theory that argues that dividends that