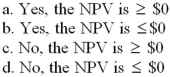

Valuation of a Merger Windows N Such,Inc.,is asking a price of $195 million to be purchased by Curtain Rods Corp.The two firms currently have cumulative total cash flows of $15 million which are growing at 1 percent annually.Managers estimate that because of synergies the merged firm's cash flows will increase by an additional 3 percent for the first four years following the merger.After the first four years cash flows will grow at a rate of 2 percent.The WACC for the merged firms is 10 percent.Calculate the NPV of the merger.Should Curtain Rods Corporation agree to acquire Windows N Such,Inc.,for the asking price of $195 million?

Definitions:

Trademarks

Legal designations and symbols that represent a company or product, providing exclusivity and protection against misuse.

Copyrights

Legal protections granted to the creators of original works, preventing others from copying or distributing their work without permission.

Stockholders' Equity

Stockholders' Equity represents the owners' claims on the assets of a corporation, calculated as the difference between total assets and total liabilities.

Financing

The act of providing funds for business activities, making purchases, or investing, either through debt, equity, or other financial instruments.

Q10: Calculating Costs of Issuing Stock River Valley

Q44: Calculating Costs of Issuing Stock Volleyball Gear,Inc.,with

Q48: CJ Corp.is expected to pay a dividend

Q52: Lucky Louie qualified for a $250,000 mortgage

Q66: Arbitrage profit can be made by:<br>A)selling assets

Q74: Your company faces a 34 percent tax

Q74: Social Security is the easiest disability coverage

Q79: The total cost of owning a home

Q96: Exchange Rate Quote Convert the following direct

Q108: Which of the following would you not