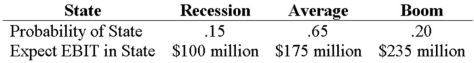

Your company doesn't face any taxes and has $750 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 30 percent debt capital structure,and has determined that they would have to pay a 9 percent yield on perpetual debt in either event.What will be the standard deviation in EPS if they switch to the proposed capital structure?

Definitions:

Business Letter Styles

The formats or layouts traditionally used for professional correspondence, including block, modified block, and semi-block styles.

Table Move Handle

A feature in various applications, including Microsoft Word, used to reposition tables by clicking and dragging.

Entire Table

Refers to selecting or referencing all the rows and columns in a given table within a database or spreadsheet.

Date Line

A line in written material that indicates when the document was written or published, often found in letters and press releases.

Q8: You are evaluating a product for your

Q22: Which of the following is a capital

Q40: You are evaluating a project for your

Q47: Which of the following is NOT an

Q51: Suppose that the 2013 actual and 2014

Q83: Suppose a firm has had the historical

Q101: Which of the following describes the type

Q109: An all-equity financed firm has $650 in

Q116: Law of One Price If the price

Q137: If a firm has a cash cycle