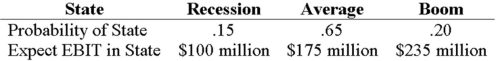

Your company has a 40 percent tax rate and has $750 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown follows:

The firm is considering switching to a 30 percent debt capital structure,and has determined that they would have to pay a 9 percent yield on perpetual debt in either event.What will be the standard deviation in EPS if they switch to the proposed capital structure?

Definitions:

Mental Status Examination

A structured assessment of a patient's cognitive, emotional, and psychological functioning.

Assessment Interview

An evaluative conversation aimed at understanding an individual’s condition, needs, or performance.

Mental Status Examination

A systematic collection of data based on observation of a patient's behavior, aimed at assessing cognitive, emotional, and psychological function.

Fever and Vomiting

Symptoms often associated with infections or other medical conditions, indicating the body's response to fight off illness.

Q2: Which of the following would cause dividends

Q33: Which of these is the idea that

Q34: Under what conditions can a rate-based statistic

Q43: Suppose a firm has had the historical

Q90: Most business loans today are:<br>A)pre-negotiated lines of

Q97: If an investor wanted to reduce the

Q98: Compute the PI statistic for Project X

Q113: Calculating Costs of Issuing Stock WuShock,Inc.,needs to

Q124: Detail the major differences between the three

Q132: List and explain the "five C's" of