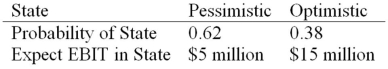

HiLo,Inc.,doesn't face any taxes and has $100 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt.What will be the level of expected EPS if they switch to the proposed capital structure?

Definitions:

Monthly Workshops

Regularly scheduled events that focus on teaching or exploring specific topics or skills in depth.

Equilibrium Wage

The wage rate at which the quantity of labor supplied equals the quantity of labor demanded in a particular market.

Equilibrium Wage

The wage rate at which the quantity of labor supplied equals the quantity of labor demanded, leading to a balance in the labor market.

After-School Tutoring

A program designed to provide additional academic support to students beyond the regular school hours.

Q3: How does a best effort underwriting differ

Q3: List and explain the three dimensions of

Q23: LD Inc.declared bankruptcy through a Chapter 7

Q57: Exchange Rate Quote Convert the following indirect

Q62: George's Dry Cleaning is considering a merger

Q73: Which of the following statements is correct?<br>A)A

Q77: Which of the following statements is correct?<br>A)Discounted

Q82: Convert the following direct quote to dollar

Q95: When does a dividend become a firm

Q106: Valuation of a Merger The managers of