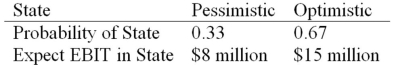

HiLo,Inc.,doesn't face any taxes and has $100 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt.What will be the standard deviation in EPS if they switch to the proposed capital structure?

Definitions:

Tariffs

Taxes imposed by a government on goods and services imported from other countries, often used to protect domestic industries.

United States

A country located in North America, known for its large economy and diverse population.

Price

The payment sum forecasted, compelled, or allocated for a specific transaction.

Import

The act of bringing goods or services into a country from abroad for the purpose of trade or sale.

Q8: For most investors,the equalization of the tax

Q29: If Whole Foods grocery store buys Whole

Q36: Suppose that the financial ratios of a

Q44: What is computed by dividing the amount

Q53: For a project with normal cash flows,what

Q64: KADS,Inc.,has spent $400,000 on research to develop

Q71: Compute the PI statistic for Project Q

Q76: Suppose a firm pays total dividends of

Q81: A project costs $101,000 today and is

Q93: Your firm needs a computerized machine tool