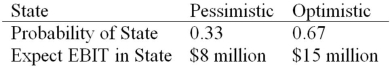

HiLo,Inc.,doesn't face any taxes and has $100 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt.What will be the break-even level of EBIT?

Definitions:

Q6: Suppose a firm has a dividend payout

Q6: If a firm has a cash cycle

Q10: Which of the following is correct?<br>A)Stock prices

Q20: If the price of copper in Europe

Q30: The board of directors announces its intention

Q57: Balloons,Inc.normally pays a quarterly dividend.The last such

Q63: Why is a project's cost not an

Q79: Calculating Costs of Issuing Debt Home Improvement,Inc.,needs

Q115: Which of the following statements is incorrect?<br>A)While

Q127: Explain why one would need to be