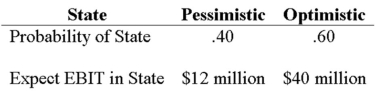

Your company doesn't face any taxes and has $300 million in assets,currently financed entirely with equity.Equity is worth $15 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 30 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt in either event.What will be the level of expected EPS if they switch to the proposed capital structure?

Definitions:

Residual Income Claimants

Individuals or entities entitled to the income that remains after all other expenses and obligations have been met, typically referring to owners or shareholders.

Operational Efficiency

The ability of an organization to minimize inputs and costs while maximizing outputs and services.

Market Rate

The prevailing price or interest rate for goods, services, or securities in a competitive market.

Principal-Agent Problem

A dilemma in which an agent (employee or representative) may not act in the best interest of the principal (employer or client) due to differing objectives and information asymmetry.

Q2: Calculating Costs of Issuing Stock TriState Corp.recently

Q22: Which of the following is a formal

Q28: The Russian financial crisis of 1998 caused

Q42: Economies of Scope A survey of a

Q48: Contrast the difference between first order effects

Q54: A decrease in net working capital (NWC)is

Q75: Rate-based statistics represent summary cash flows,and these

Q82: KJ Enterprises estimates that it takes,on average,three

Q106: You have been asked by the president

Q109: What important tax-based reason suggests why some