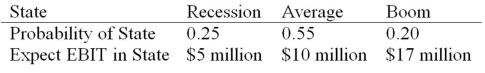

Daddi Mac,Inc.,doesn't face any taxes and has $250 million in assets,currently financed entirely with equity.Equity is worth $13 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities as shown below:

The firm is considering switching to a 25 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt.What will be the standard deviation in EPS if they switch to the proposed capital structure?

Definitions:

Two-Layered Study

A research approach that examines a topic or phenomenon at two different levels of analysis or perspectives to gain a more comprehensive understanding.

Informal Social Networks

The unofficial and often not visible interconnections among individuals within an organization that influence the flow of information, facilitating social and professional interactions.

Structural Positions

The designated roles, responsibilities, and levels of authority within an organization's hierarchy.

Organizational Change

The process through which a company undergoes a significant transition in its operations, structure, or strategy.

Q5: All of the following are examples of

Q6: Suppose a firm has a dividend payout

Q8: For most investors,the equalization of the tax

Q14: Your company has a 38 percent tax

Q31: You have been asked by the president

Q39: Which of these is the type of

Q77: What causes the change in optimal strategy

Q91: In 2004,Microsoft paid one of the largest

Q103: Suppose your firm is considering investing in

Q105: What is meant when it is said