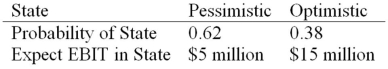

HiLo,Inc.,doesn't face any taxes and has $100 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt.What will be the level of expected EPS if they switch to the proposed capital structure?

Definitions:

Issues Involved

The specific problems, challenges, or areas of concern that are part of a situation or discussion.

Typical Types

Common or usual categories or forms within a broader group or classification.

Organizational Culture

The shared values, beliefs, and behaviors that determine how a company's employees and management interact.

Levels Exist

A phrase indicating that within a structure or system, multiple layers or stages are present.

Q1: Suppose a firm has a retention ratio

Q5: Suppose exchange rates between the U.S.dollar and

Q56: Bailey's Dog Pens,Inc.,with the help of its

Q60: The level of EBIT at which EPS

Q83: The inventory order quantity that minimizes total

Q89: Suppose that Freddy's Fries has annual sales

Q92: Jenny's Day Care is considering a merger

Q96: Cost savings not directly due to economies

Q124: Detail the major differences between the three

Q128: All of the following are examples of