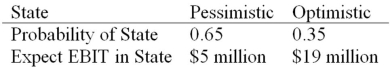

HiLo,Inc.,doesn't face any taxes and has $100 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure,and has determined that they would have to pay a 15 percent yield on perpetual debt.What will be the break-even level of EBIT?

Definitions:

HDC Status

Holder in Due Course Status; a term in negotiable instruments law referring to a person who has acquired a negotiable instrument in good faith for value, and thus has certain protections.

Negotiable Instrument

A written promise or order to pay a specific amount of money, easily transferable from one party to another.

Face Value

The nominal or original value stated on a financial instrument, such as a bond or currency bill, not necessarily its current market value.

Possession

The state of having, owning, or controlling something, either tangibly or legally.

Q22: All of the following are political risks

Q25: Suppose that Sam Industries has annual sales

Q35: Which of these is defined as the

Q37: Your company is considering the purchase of

Q48: Compute the discounted payback statistic for Project

Q52: Your firm needs a machine which costs

Q53: A professionally managed pool of money used

Q55: Choc Hut,Inc.normally pays a quarterly dividend.The last

Q70: When Starbucks opens a location in Mexico

Q119: All else the same,firms facing relatively high