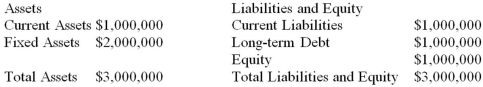

Suppose that PBJ Industries,Inc.currently has the balance sheet shown as follows,and that sales for the year just ended were $10 million.The firm also has a profit margin of 10 percent,a retention ratio of 25 percent,and expects sales of $12 million next year.If all assets and current liabilities are expected to increase with sales,what amount of additional funds will the company need from external sources to fund the expected growth?

Definitions:

Interest Revenue

Earnings generated by providing loans or placing money into financial vehicles that accrue interest.

Temporary Investment

Short-term investments made by a company to earn a return on idle cash without impacting its liquidity.

Long-Term Investment

Investments held for an extended period, usually more than one year, with the intention of gaining significant returns over time.

Dividends Received

Income earned from investments in the form of payments distributed by a corporation to its shareholders.

Q10: Which of the following is correct?<br>A)Stock prices

Q13: All of the following will result in

Q30: The board of directors announces its intention

Q44: What is computed by dividing the amount

Q65: Compute the NPV for Project X and

Q75: Section 179 allows a business,with certain restrictions,to

Q87: Which of the following current asset financing

Q98: Which of the following is the condition

Q113: Currency Exchange Compute the number of dollars

Q116: Law of One Price If the price