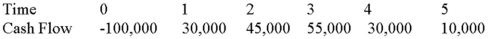

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the payback decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Published

The process of making something publicly known or available, typically through printing or electronic posting.

Testable Ideas

Concepts or hypotheses that can be empirically investigated through experimentation or observation.

Empiricism

A philosophical standpoint emphasizing evidence-based knowledge acquired through observation and experimentation.

Falsifiability

A principle stating that for a hypothesis to be scientifically valid, it must be possible to conceive an observation or an argument which could negate it.

Q8: When calculating WACC,should project-specific or firmwide debt

Q29: How can one account for movements in

Q35: Which of the following is the tendency

Q40: A company is considering two mutually exclusive

Q68: Your company is considering the purchase of

Q68: Suppose a firm has had the historical

Q112: If a firm has a cash cycle

Q122: Contrast the use of the internal rate

Q130: Cup Cake Ltd.has 20 million shares of

Q133: Which of these is the period of