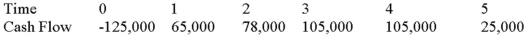

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.

Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Demand for Health Care

The total amount of health care services that consumers are willing and able to purchase at a given price level.

Price-Inelastic

A characteristic of a product or service whose demand does not significantly change with a change in its price.

Budget Constraint

The limitation on the consumption bundles that a consumer can afford based on their income and the prices of goods and services.

Luxury

Goods or services that are considered non-essential but desirable and associated with high-quality and high price.

Q33: A firm uses only debt and equity

Q49: Goldilochs Inc.reported sales of $8 million and

Q52: To find the percentage return of an

Q59: Articulate the rationale of the additional funds

Q65: Compute the NPV for Project X and

Q72: Suppose you sell a fixed asset for

Q90: All capital budgeting techniques:<br>A)render the same investment

Q96: Which of the following statements is correct?<br>A)If

Q97: If an investor wanted to reduce the

Q119: All else the same,firms facing relatively high