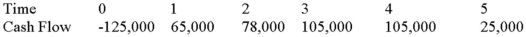

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.

Use the PI decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Charitable Remainder Trusts

A type of trust that provides a donor with income for a period of time, with the remaining assets going to charity upon the trust's termination.

Operating Expenses

The costs associated with the day-to-day functioning of a business or organization, not including the cost of goods sold.

Hyperagency

A state or condition characterized by an exaggerated emphasis on individual agency or the capacity to act independently and make free choices, potentially neglecting broader systemic or structural influences.

Beneficence

The ethical principle of doing good, often applied in healthcare contexts to refer to actions that promote the well-being of individuals and the public.

Q23: JAK Industries has 5 million shares of

Q24: Which of the following is used to

Q34: Suppose a firm pays total dividends of

Q61: Which of these statements is true?<br>A)When people

Q65: Suppose a firm has a retention ratio

Q74: You are evaluating a project for your

Q91: Which statement makes this a false statement?

Q91: Explain the process of financial planning process

Q100: The Jobs and Growth Tax Relief Reconciliation

Q112: Which strategy-active or passive capital structure management-would