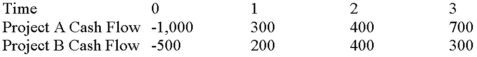

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.

Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Fiat Money

Money without intrinsic value that is used as money by government decree

Money

The set of assets in an economy that people regularly use to buy goods and services from other people.

Wealth

The accumulation of valuable economic resources and assets, including property, investments, and cash, that an individual or entity possesses.

Roundabout Trade

Trade involving multiple countries where goods are exported to one country before being re-exported to the final destination.

Q27: A firm has retained earnings of $11

Q33: A manufacturing firm is planning on expanding

Q62: Suppose that Road Industries currently has the

Q65: Suppose a firm has a retention ratio

Q82: TJ Industries has 7 million shares of

Q83: Suppose two projects with normal cash flows,X

Q87: Compute the MIRR statistic for Project I

Q95: Reese's Resources faces a smooth annual demand

Q102: We commonly measure the risk-return relationship using

Q110: Compute the IRR for Project X and