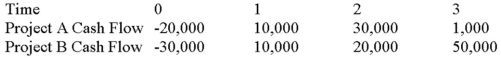

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.

Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Client Satisfaction

The degree to which a client feels that the service or product provided meets or exceeds their expectations.

Tardive Dyskinesia

A neurological disorder characterized by involuntary, repetitive movements, often affecting the face, resulting from long-term use of certain psychiatric drugs.

Antipsychotic

A class of medication primarily used to manage psychosis, including delusions, hallucinations, and disorders such as schizophrenia.

Double-Blind Technique

An experimental procedure in which neither the participants nor the experimenters know who is receiving a particular treatment, used to prevent bias in research results.

Q36: Which of the following current asset financing

Q42: Suppose a firm has had the historical

Q51: Explain why the divisional cost of capital

Q54: A financial asset will pay you $50,000

Q65: Suppose a firm has a retention ratio

Q79: Which of the following would cause dividends

Q88: If a firm is going to take

Q95: AB Mining Company just commissioned a firm

Q105: Suppose a firm has a retention ratio

Q111: "The net amount of current assets that