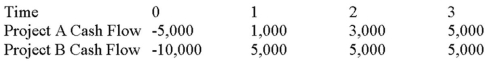

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.

Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Q17: The research chemists at MegaClean created a

Q69: Suppose that Wind Em Corp.currently has the

Q72: Suppose you sell a fixed asset for

Q72: Compute the payback statistic for Project X

Q80: Required Return If the risk-free rate is

Q93: All of the following are strengths of

Q98: Which of the following is incorrect?<br>A)Most firms

Q102: Explain how Irving Fisher's separation principle addresses

Q105: Suppose that Freddie's Fries has annual sales

Q107: Portfolio Beta You own $2,000 of City