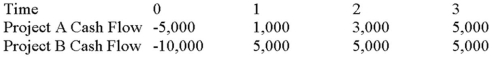

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.

Use the NPV decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Expelled

The act of being formally removed from an institution, like a school, as a disciplinary measure.

Math And Science Exams

Standardized tests or assessments used to evaluate a student's understanding and knowledge in mathematics and science subjects.

Physical Preparation

Training and conditioning of the body for improved performance and resilience in physical activities, sports, or for health reasons.

Emotional Preparation

The process of readying one's emotional state to handle specific situations or challenges effectively.

Q20: PBJ Enterprises estimates that it takes,on average,three

Q47: Which of these are sets of cash

Q50: Whenever a set of stock prices go

Q61: Portfolio Beta You have a portfolio with

Q69: A firm uses only debt and equity

Q69: Elle Mae Industries has a cash balance

Q85: WC Inc.has a $10 million (face value),10-year

Q87: Which of the following is NOT included

Q88: Rank the following three stocks by their

Q115: Which of these statements is true regarding