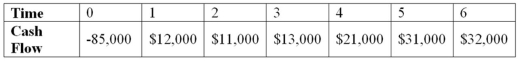

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the NPV decision to evaluate this project; should it be accepted or rejected?

Definitions:

Granting Claims

The process of acknowledging and agreeing to a request or demand, often in the context of customer service or insurance.

Requests For Adjustment

Requests for adjustment are formal or informal appeals to a company or individual asking for a change or correction in service or product that did not meet expectations.

Company Fault

Situations where a business is responsible for a mistake, negligence, or failure to perform as expected.

Customer's Inconvenience

A situation or issue faced by a customer that causes difficulty or discomfort, often needing resolution or compensation.

Q4: What two main factors come into play

Q17: The research chemists at MegaClean created a

Q57: Which of the following is defined as

Q75: Rate-based statistics represent summary cash flows,and these

Q76: Team Sports Industries has a cash balance

Q83: Suppose two projects with normal cash flows,X

Q97: Consider the risk-return relationship in T-bills during

Q105: Portfolio Return The following table shows your

Q115: Your company has a 40 percent tax

Q120: Suppose that LilyMac Photography has annual sales