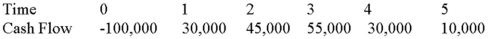

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the payback decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Neurogenesis

The process of the formation of new neurons in the brain.

Split Brain

A condition resulting from surgery that isolates the brain’s two hemispheres by cutting the fibers (mainly those of the corpus callosum) connecting them.

Corpus Callosum

The large band of neural fibers connecting the two hemispheres of the brain, facilitating communication and coordination between them.

Somatosensory Cortex

A region of the brain located in the parietal lobe that processes sensory information from various parts of the body, such as touch, temperature, and pain.

Q22: Which of the following is typically considered

Q41: The benchmark for the profitability index (PI)is

Q47: Your company doesn't face any taxes and

Q55: Your company doesn't face any taxes and

Q68: Your company is considering the purchase of

Q95: In M&M's perfect world,their theorem's two main

Q97: Suppose your firm has decided to use

Q105: An estimated WACC computed using some sort

Q121: One way to account for flotation costs

Q123: Would it be worth it to incur