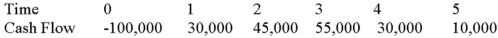

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Conditioned Response

A learned reaction to a previously neutral stimulus as a result of repeated associations with a stimulus that elicits an automatic response.

Media Violence

The depiction of aggressive or harmful behavior in various forms of media, and its potential impact on audience behavior and attitudes.

Aggressive Behaviour

Aggressive behaviour is actions intended to harm or intimidate others, which can be physical or verbal, and motivated by various underlying factors.

Long-Term Effects

The lasting consequences or impacts of an event, action, or condition that may not be apparent immediately but are observed over a prolonged period.

Q25: A manager believes his firm will earn

Q39: You own $9,000 of Olympic Steel stock

Q40: You are evaluating a project for your

Q48: Suppose that Beach Blanket's common shares sell

Q56: CAPM Required Return A company has a

Q80: Your company is considering a new project

Q87: Suppose that Tan Lines' common shares sell

Q102: Compute the IRR statistic for Project X

Q121: Suppose that TNT,Inc.has a capital structure of

Q123: Would it be worth it to incur