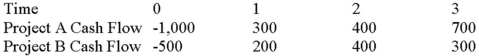

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.

Use the MIRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

G Proteins

A family of proteins that act as molecular switches inside cells, involved in transmitting signals from stimuli outside the cell to its interior.

MAP Kinases

A family of proteins that play a critical role in transmitting signals from the cell surface to the nucleus, affecting cellular activities like division, differentiation, and response to environmental stimuli.

Calmodulin

A calcium-binding messenger protein that plays a key role in cellular processes by activating enzymes, ion channels, and other proteins.

Signal Transduction

The process by which a cell converts one kind of signal or stimulus into another, involving a series of molecular changes leading to a cellular response.

Q10: Coke is planning on marketing a new

Q14: Paper Exchange has 80 million shares of

Q31: Which of the following is a reason

Q42: State the order claimants will be paid

Q51: Suppose that the 2013 actual and 2014

Q63: An all-equity financed firm has $500 in

Q65: ADK Industries common shares sell for $40

Q80: Required Return If the risk-free rate is

Q83: Hastings Entertainment has a beta of 1.24.If

Q110: If a firm has already paid an