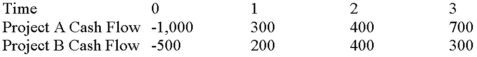

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.

Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Accounting-Based Covenants

Agreements or clauses within contracts that require a borrower to meet certain financial metrics or conditions, based on accounting figures.

Net Worth

The total value of all assets a company or individual owns, minus any liabilities owed, indicating financial strength or wealth.

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term liquidity and operational efficiency.

Executive Pay

Compensation that includes salaries, bonuses, stocks, and other financial benefits provided to top-level management and executives.

Q5: First order effects are defined as which

Q19: Your company faces a 34 percent tax

Q28: Which of the following is incorrect regarding

Q32: Which of the following is NOT a

Q43: Suppose a firm has had the historical

Q72: Apple's 9 percent annual coupon bond has

Q77: Which of these statements is true regarding

Q82: Goldilochs Inc.reported sales of $8 million and

Q82: KJ Enterprises estimates that it takes,on average,three

Q92: Everything held constant,would you rather depreciate a