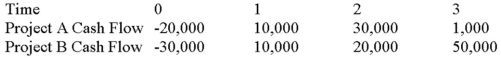

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.

Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Hermeneutical Method

An approach to interpretation and understanding that emphasizes the role of context, history, and subjective experience, particularly used in human sciences.

Concept Inventing Method

A systematic approach to generating new ideas and conceptual frameworks for solving problems or creating innovations.

Simultaneity Paradigm

A perspective in which events, actions, or processes are viewed as occurring simultaneously rather than sequentially, often emphasizing the interconnectedness of phenomena.

Humanuniverse-indivisible-unpredictable

A conceptual expression suggesting that humanity and the universe are inseparable and inherently unpredictable, emphasizing a holistic view of life and existence.

Q4: Which of these is defined as a

Q25: Which of the following best describes the

Q31: Differentiate between active and passive changes to

Q33: Compute the PI statistic for Project Z

Q36: You are evaluating a project for The

Q63: Explain Gordon and Lintner's bird-in-the-hand theory.

Q64: Oberon Inc.has a $20 million ($1,000 face

Q74: Which of the following statements is correct?<br>A)Generally

Q97: When might raising a firm's dividend payout

Q101: A financial asset will pay you $10,000