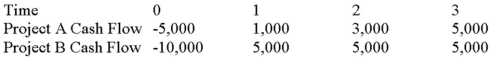

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.

Use the payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Mutagens

Agents, such as chemicals or radiation, that cause mutations or changes in the DNA of organisms.

Transcription Factors

Proteins that regulate the transcription of genes by binding to specific DNA sequences, thus controlling the flow of genetic information from DNA to mRNA.

RNA Polymerase

An enzyme responsible for synthesizing RNA from a DNA template during the process of transcription.

Promoter

A region of DNA that initiates transcription of a particular gene.

Q18: Drawing,Inc.has sales of $860,000 and cost of

Q25: Which of the following best describes the

Q38: Which of these is the set of

Q45: Compute the payback statistic for Project Y

Q57: BOGO Shoes would like to maintain their

Q85: As new capital budgeting projects arise,we must

Q86: Which of these is used as a

Q89: Which of these is the investor's combination

Q95: AB Mining Company just commissioned a firm

Q110: We use the term leverage to describe