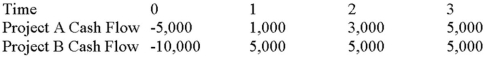

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.

Use the MIRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Unevenness

The quality of being not uniform or equal in surface, area, or volume; irregularity.

Mental Modules

Hypothetical structures in the brain proposed to be specialized for processing specific types of information, based on the theory of modularity.

Internal Mental Structures

The cognitive constructs within an individual's mind that facilitate understanding, reasoning, and information processing.

Phonemes

The smallest sound categories in human speech that distinguish meanings. Phonemes vary from language to language.

Q3: Which of the following statements is correct

Q5: All of the following are examples of

Q25: FarCry Industries,a maker of telecommunications equipment,has 6

Q30: How do replacement projects' cash flows differ

Q53: IBM's stock price is $22,it is expected

Q74: Your company faces a 34 percent tax

Q92: U.S.Bancorp holds a press conference to announce

Q93: Your firm needs a computerized machine tool

Q118: Which of the following statements is correct?<br>A)The

Q120: A local bank is contemplating opening a