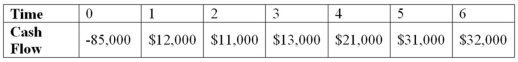

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the IRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Quantity Supplied

The amount of a particular good or service that suppliers are willing and able to provide at a given price during a certain period.

Demand Function

A mathematical expression showing the relationship between the quantity demanded of a good and its price, holding other factors constant.

Supply Function

A numerical model illustrating how the amount of a product provided is related to its cost.

Subsidy

A subsidy is a financial contribution provided by the government or a public body to support businesses, consumers, or sectors, reducing the price of goods or services.

Q17: JEN Corp.is expected to pay a dividend

Q24: Which of the following is used to

Q77: Rose Axels faces a smooth annual demand

Q83: Suppose that a company's equity is currently

Q90: Stock Market Bubble If the NASDAQ stock

Q91: A company is considering two mutually exclusive

Q96: Which of these is the assumption that

Q103: Rose Resources faces a smooth annual demand

Q106: Which of the following is a short-term

Q118: If a firm's inventory ratio increases,what will