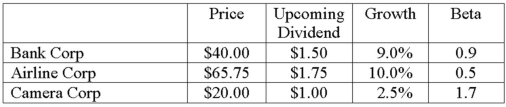

Required Return Using the information in the table,compute the required return for each company using both CAPM and the constant growth model.Compare and discuss the results.Assume that the market portfolio will earn 11 percent and the risk-free rate is 2.5 percent.

Definitions:

Capital Components

The various sources of funding that a company uses to finance its operations and growth, including debt and equity.

Capital Structure

The mix of the three capital components (debt, preferred stock, and equity) used by a firm. The optimal capital structure is the structure at which stock price is maximized, all other things held equal. Also see Target capital structure.

Equity

The value of an ownership interest in property, including shareholders' equity in a company.

Tax Deductible

Expenses that can be subtracted from gross income, lowering the taxable income and thus the amount of tax owed.

Q1: Which of the following will increase the

Q5: Risk Premiums You own $14,000 of Diner's

Q10: We often use the P/E ratio model

Q16: Consider the characteristics of the following three

Q31: You have been asked by the president

Q54: Stock valuation model dynamics make clear that

Q63: What does diversification do to the risk

Q66: Identify and explain a common measure for

Q71: Land O Lakes Systems has a beta

Q121: Bond Ratings and Prices A corporate bond