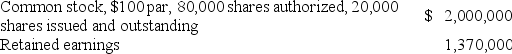

The following items appeared on the financial statements of Monroe, Inc. on December 31, Year 1:

On September 10, Year 2, when the market value of the Monroe stock was $140, the company declared and distributed an 8% stock dividend. Indicate whether each of the following statements is true or false.

On September 10, Year 2, when the market value of the Monroe stock was $140, the company declared and distributed an 8% stock dividend. Indicate whether each of the following statements is true or false.

_____ a) Retained earnings would increase by $224,000 as a result of the stock dividend.

_____ b) The balance in common stock would increase by $64,000 as a result of the stock dividend.

_____ c) Total paid-in capital would be $2,224,000 after the dividend had been distributed.

_____ d) Total equity would not be affected by the dividend.

_____ e) Cash flow from financing activities would increase by $224,000 as a result of the stock dividend.

Definitions:

Yield Measures

Financial metrics that represent the earnings generated and realized on an investment over a particular period, expressed as a percentage of the investment's cost or current value.

Materials Output

The total quantity of materials produced or supplied, often used in manufacturing and production contexts.

Process Costing System

An accounting method used where similar products are mass-produced, expenses are averaged over the units, making it easier to determine per-unit costs.

Cost Of Goods Sold

The immediate expenses linked to manufacturing goods sold by a company, encompassing both materials and labor costs.

Q12: Vogle Company purchased $8,000 of equipment by

Q15: Assume the perpetual inventory method is used.<br>1)

Q45: Foote Company recorded a purchase discount of

Q62: A distribution by a sole proprietorship to

Q65: Which formula best represents the first step

Q70: The study of an individual financial statement

Q76: Bluestone Company issued bonds with a face

Q81: A company purchased inventory on account. If

Q99: Chase Co. uses the perpetual inventory method.

Q104: All lawsuits in which a company has