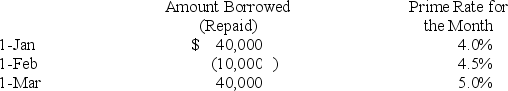

Franklin Company obtained a $160,000 line of credit from the State Bank on January 1, Year 1. The company agreed to accept a variable interest rate that was set at 2% above the bank's prime lending rate. The bank's prime rate of interest and the amounts borrowed or repaid during the first three months of Year 1 are shown in the following table. Assume that Franklin borrows or repays on the first day of each month. Borrowing is shown as a positive amount and repayments are shown as negative amounts indicated by parentheses.  Based on this information alone, the amount of interest expense recognized in March would be closest to:

Based on this information alone, the amount of interest expense recognized in March would be closest to:

Definitions:

Excess Reserves

The reserves held by a bank in excess of the minimum reserve requirements set by central banking authorities.

Required Reserves

The minimum amount of reserves that banks are required to hold by law, as a safeguard against bank runs.

Demand Deposits

Bank account balances that can be withdrawn on demand without any notice, such as in checking accounts.

Credit Availability

The ease with which individuals and businesses can obtain loans or credit, often influenced by interest rates and economic policies.

Q8: Which of the following items would be

Q19: Butch's Barbecue thinks that offering delivery will

Q31: Recognizing depreciation expense on equipment or a

Q38: Common size financial statements are prepared by

Q41: The Rupert Company purchased a delivery van

Q48: Harding Corporation acquired real estate that contained

Q59: As of December 31, Year 1, Gant

Q61: Product costs are reported on the income

Q85: The depreciable cost of a long-term asset

Q107: Issuing a note payable is a(n):<br>A) claims