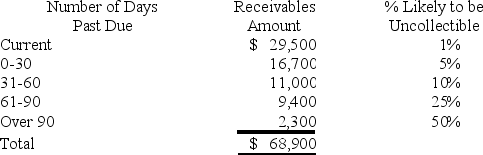

Barton Corporation uses the aging of accounts receivable method of accounting for uncollectible accounts. As of December 31, Year 1, prior to estimating uncollectible accounts expense, Barton's balance of accounts receivable was $68,900, the balance of allowance for doubtful accounts was $2,500, and total sales for Year 1 were $875,000. On December 31, Year 1, Barton aged its receivables and determined the following:

Indicate whether each of the following statements is true or false.

Indicate whether each of the following statements is true or false.

_____ a) Barton will report Net Realizable Value of Accounts Receivable equal to $63,170 on its December 31, Year 1 balance sheet.

_____ b) Barton will report Uncollectible Accounts Expense of $5,730 on its Year 1 income statement.

_____ c) The December 31 adjusting entry related to uncollectible accounts will increase liabilities and decrease equity by $3,230.

_____ d) The method Barton uses to account for uncollectible accounts is known as the balance sheet approach.

_____ e) Write-offs of uncollectible accounts in Year 2 will reduce Barton's net realizable value of receivables.

Definitions:

Self-Directed Teams

Groups of individuals who manage their own workload and operations, typically without direct supervision.

Interdependent Tasks

Work assignments or projects that require two or more individuals or groups to collaborate and rely on each other to succeed.

Calculus-Based Trust

A form of trust grounded in the expectation that others will act predictably based on past interactions and personal gain.

American Companies

Pertains to businesses or corporations that are established, registered, and operate primarily within the United States.

Q10: One company's practice is to provide bonuses

Q16: On January 6, Year 1, the Mount

Q27: If a bond is sold at 101,

Q29: Park Enterprises issued bonds with a term

Q41: If the financial statements cannot be relied

Q51: Which of the following statements about types

Q52: The current ratio is one of the

Q59: Payment of interest on a note payable

Q81: The Dennis Company reported net income of

Q95: In December Year 1, Lucas Corporation sold