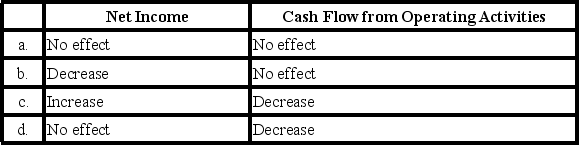

On December 31, Year 1, Gaskins Co. owed $4,500 in salaries to employees who had worked during December but would be paid in January. If the year-end adjustment is properly recorded on December 31, Year 1, what will be the effect of this accrual on the following items for Gaskins?

Definitions:

Tax Rate

The percentage at which an individual or corporation is taxed by the government.

After-Tax Cost

The actual cost of an expense or investment to a company or individual after accounting for the effects of taxes.

WACC

The Weighted Average Cost of Capital (WACC) refers to the average rate of return a company is expected to pay to its security holders to finance its assets.

Debt Ratio

The debt ratio is a financial metric that measures the extent of a company’s leverage, calculated by dividing total liabilities by total assets.

Q4: Chester Company has established internal control policies

Q9: When a building is purchased simultaneously with

Q25: At the break-even point:<br>A) Sales would be

Q37: At a time of declining prices, which

Q63: On January 1, Year 2, Kincaid Company's

Q72: Indicate whether each of the following statements

Q77: Which of the following items is an

Q89: Purchases on account are given below: <img

Q92: Stosch Company's balance sheet reported assets of

Q101: Frank Company earned $15,000 of cash revenue.