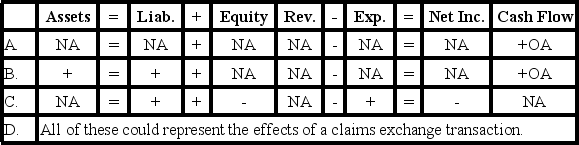

Which of the following describes the effects of a claims exchange transaction on a company's financial statements?

Definitions:

Gross Wages

The total amount of salary or wages earned by an employee before any deductions or taxes are applied.

Social Security

A governmental program providing financial assistance to people with inadequate or no income, especially the elderly, disabled, and families with dependent children.

Unemployment Taxes

This term refers to taxes imposed on employers based on the wages paid to employees, used to fund unemployment insurance programs.

Warranty Obligations

A company's legal responsibility to repair or replace defective products within a specified period.

Q1: When prices are falling, LIFO will result

Q6: All of a business's temporary accounts appear

Q18: As activity increases, the fixed cost per

Q25: At the break-even point:<br>A) Sales would be

Q28: Which of the following would represent the

Q60: Which of the following costs is an

Q73: With a periodic inventory system, the cost

Q75: The following accounts and balances were drawn

Q86: Laramie Co. paid $800,000 for a purchase

Q110: Java Joe operates a chain of coffee