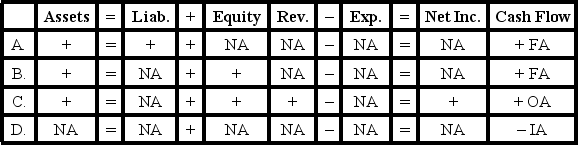

Which of the following would not describe the effects of an asset source transaction on a company's financial statements?

Definitions:

Marginal Tax Rate

The rate of tax imposed on your income, corresponding to each applicable tax bracket.

Average Tax Rate

Total taxes paid divided by total taxable income.

Net Working Capital

The difference between a company’s current assets and current liabilities, indicating the liquidity of the business.

Statement of Comprehensive Income

A financial report detailing all equity adjustments for a period, excluding those changes stemming from owner investments and payouts to owners.

Q25: Requiring separation of duties in a business

Q29: Packard Company engaged in the following transactions

Q43: Which of the following would be considered

Q53: Tandem Company borrowed $32,000 of cash from

Q62: A static budget is one that shows

Q68: Volume variances are computed for which of

Q69: In uncertain circumstances, the conservatism principle guides

Q71: Achieving the sales volume in the master

Q83: Vargas Company sold a piece of land

Q90: A difference between the static budget based