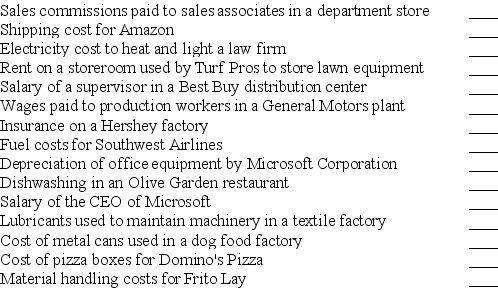

Costs that might be incurred by service, merchandising, and manufacturing companies are described below:

Required:

Required:

Classify each cost as variable (V) or fixed (F) with respect to volume or level of activity.

Definitions:

Adjusted Gross Income

An individual's total gross income minus specific deductions, used to determine taxable income and eligibility for certain tax benefits.

At-Risk Amount

The maximum amount of money an investor stands to lose in an investment, which limits loss deduction claims for tax purposes.

Passive Loss Rules

are tax rules that limit the ability to deduct losses from passive activities unless the taxpayer materially participates in the activity.

Passive Activity

Economic activities in which the investor does not materially participate, often related to rental property or businesses in which the person does not actively manage.

Q11: Which of the following statements is FALSE?<br>A)

Q16: Easton Company makes and sells scooters. Easton

Q32: Glavine Company repaid a bank loan with

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3570/.jpg" alt=" What is the

Q53: Tandem Company borrowed $32,000 of cash from

Q55: When computing the break-even point in units,

Q61: What are some implicit assumptions that are

Q73: The price you would be willing to

Q83: Assume the appropriate discount rate for this

Q101: A margin of safety of 30% means