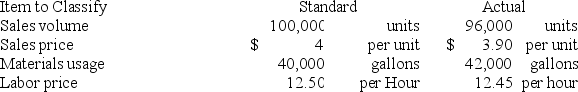

The sales volume variance was:

The sales volume variance was:

Definitions:

Option Contracts

Financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

Swap Contracts

Financial agreements between two parties to exchange cash flows or other financial instruments for a specified period of time.

Put Option

A contract in finance that provides the bearer the privilege, but avoids the necessity, to dispense a specific measure of an underlying asset at a particular price during an outlined period.

Options Contract

A contract giving the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on or before a certain date.

Q6: The IRR for Larry's three movie deal

Q9: Assuming that Dewey's cost of capital is

Q10: You expect KT Industries (KTI) will have

Q14: Consider the following information: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3570/.jpg" alt="Consider

Q44: Which of the following statements is FALSE?<br>A)

Q48: Packard Company engaged in the following transactions

Q52: Assuming that Casa Grande Farms depreciates these

Q62: A static budget is one that shows

Q91: The inventory purchases budget is based on

Q101: Frank Company earned $15,000 of cash revenue.