Use the information for the question(s)below.

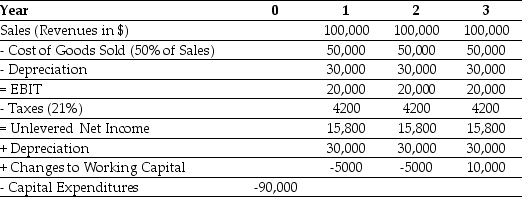

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-Epiphany would like to know how sensitive the project's NPV is to changes in the discount rate.How much can the discount rate vary before the NPV reaches zero?

Definitions:

Truly Random Numbers

Numbers generated in a way that is impossible to predict, providing an equal chance for every outcome.

Statistics

The science of collecting, analyzing, interpreting, presenting, and organizing data.

Type of Defense

Strategies or legal defenses used in legal proceedings by the accused to defend against charges.

Shooting Accuracy

The precision and reliability with which a shooter can hit a target.

Q7: The YTM of a 3 year default

Q20: The duration of a five-year bond with

Q23: Which of the following is not typically

Q37: The British government has a consol bond

Q38: If an investment providing a nominal return

Q44: Wyatt oil is contemplating issuing a 20-year

Q71: Consider a corporate bond with a $1000

Q77: Two different costs incurred by Ruiz Company

Q81: Rearden's expected dividend yield is closest to:<br>A)

Q91: Which of the following would increase residual