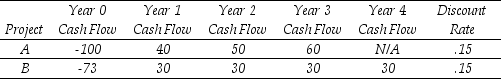

Use the table for the question(s) below.

Consider the following two projects with cash flows in $:

-The payback period for project A is closest to:

Definitions:

Risk-Free Rate

The expected return on an investment that carries no risk, often shown through the yield of government bonds.

Expected Stock Market Return

The predicted average return of the stock market or a specific segment of it over a specific period, considering historical trends and market conditions.

Dividends

Payments made by a corporation to its shareholder members, distributed from the company's profits.

Beta

A measure of a stock's volatility in relation to the overall market; a beta higher than 1 indicates greater volatility.

Q14: Which of the following statements is FALSE?<br>A)

Q19: Henry Rearden is saving for retirement and

Q48: The internal rate of return rule can

Q61: Kampgrounds Inc. is considering purchasing a parcel

Q80: Stafford Company prepared a static budget for

Q80: Costs that are not related to any

Q83: Assume the appropriate discount rate for this

Q91: Which of the following formulas is INCORRECT?<br>A)

Q93: The incremental unlevered net income in the

Q101: Timberlake Company planned for a production and