Use the table for the question(s) below.

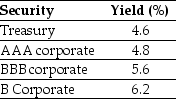

Consider the following yields to maturity on various one-year zero-coupon securities:

-The price (expressed as a percentage of the face value) of a one-year,zero-coupon corporate bond with a BBB rating is closest to:

Definitions:

365-Day Year

A method used in various financial calculations that assumes a year consists of exactly 365 days.

Maturity Value

The total amount payable to the holder of a financial instrument at its maturity date, including principal and any accrued interest.

360-Day Year

An accounting convention that simplifies interest calculation by assuming all months have 30 days.

Maturity Date

The date on which the principal amount of a loan, bond, or other financial instrument becomes due and payable.

Q13: The Century 22 fund has invested in

Q16: Von Bora Corporation (VBC) is expected to

Q30: Luther Industries is offered a $1 million

Q33: Which of the following statements is FALSE?<br>A)

Q49: Assuming that costs continue to increase an

Q49: The price today of a 4 year

Q53: Which of the following statements is FALSE?<br>A)

Q62: The amount that the price of bond

Q73: To attain a target profit, the total

Q76: Assuming that Novartis AG (NVS) has an