Use the information for the question(s)below.

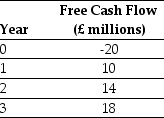

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-Calculate the pound denominated cost of capital for Luther's project.

Definitions:

Q8: The lease is treated as a capital

Q24: Using the covered interest parity condition, the

Q28: Taggart Transcontinental has issued at par a

Q41: Floyd Ferris invested $3,000 into an account

Q42: Which of the following statements is FALSE?<br>A)

Q48: Which of the following is NOT a

Q50: Which of the following is NOT one

Q77: Which of the following statements is FALSE?<br>A)

Q80: You have been offered the following investment

Q92: Because of a catastrophic plane crash, the