Use the information for the question(s)below.

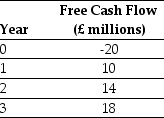

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-What is the pound present value of the project?

Definitions:

Simple Face Mask

A basic form of protective face covering, typically used in medical settings, that covers the nose and mouth.

Arterial Blood Gas

A diagnostic test that measures the levels of oxygen, carbon dioxide, and acidity (pH) in arterial blood, used to assess lung function and gas exchange.

Oxygen Saturation

A measure of the amount of oxygen carried by the hemoglobin in the blood relative to its maximum capacity, typically expressed as a percentage.

Pulse Oximetry

A non-invasive method of monitoring an individual's oxygen saturation level in the blood, often using a clip-like device on the finger.

Q4: You are offered an investment opportunity in

Q13: An exploration of the effect on NPV

Q17: Which of the following statements is FALSE?<br>A)

Q20: A lease where ownership of the asset

Q22: If your new strip mall will have

Q23: The present value of an investment that

Q24: Assuming you get 50% control of Associated

Q48: Which of the following statements is FALSE?<br>A)

Q54: You have an investment opportunity in Germany

Q58: Which of the following statements regarding the