Use the following information to answer the question(s) below.

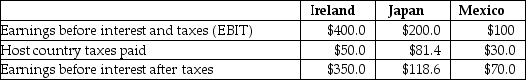

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the U.S.is currently 39%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Japanese and Mexican subsidiaries did not exist,the U.S.tax liability on the Irish subsidiary would be closest to:

Definitions:

Q7: Assuming you pay the points and borrow

Q11: Hugh Akston took out a 30-year mortgage

Q33: Which of the following statements is FALSE?<br>A)

Q35: If the discount rate for project B

Q37: Which of the following statements is FALSE?<br>A)

Q41: Luther's Accounts Payable days is closest to:<br>A)

Q45: Which of the following statements is FALSE?<br>A)

Q45: When a private equity firm purchases the

Q74: The incremental cash flow that the Krusty

Q88: The price of a five-year, zero-coupon, default-free