Use the following information to answer the question(s) below.

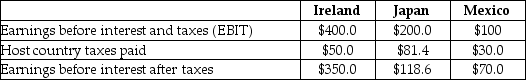

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Irish and Japanese subsidiaries did not exist,the U.S.tax liability on the Mexican subsidiary would be closest to:

Definitions:

Obsolete Desk Calculators

Outdated calculating tools that have been replaced by more modern devices but might still be found in storage or used in niche scenarios.

Financial Advantage

Refers to the benefit gained in financial terms, which could come from various sources such as lower costs, higher returns, or other financial gains.

Obsolete Desk Calculators

Refers to desk calculators that have become outdated and are no longer used due to advances in technology.

Selling Price

The cost at which a product or service is made available for purchase by a consumer.

Q17: If Microsoft merged with the Coca-Cola Company,

Q27: Which of the following money market investments

Q33: The payback period for project beta is

Q35: Rearden Metal needs to order a new

Q35: Assuming that your firm will purchase insurance,

Q40: KT Enterprises would like to construct and

Q43: Assuming that this is the venture capitalist's

Q47: If the interest rate is 7%, the

Q67: If the risk-free interest rate is 10%,

Q78: If the risk-free rate of interest is